Max Life Insurance

Max life insurance is one of the renowned insurance providers in India. This firm is established in 2000 with one aim to provide life insurance for all ages of people. The vision of the company to offer comprehensive insurance services like long-term savings, fulfill family financial goals, securing future, retirement solutions and live coverage.

Mainly in Indian, when it comes to buying life insurance policy people do not feel to invest. However, by reading top finance blogs and watching the importance of life insurance, now people have started to realize the importance of life insurance in their life.

Max Life Insurance Policy Details

The most basic requirement of life insurance in people life is that it provides financial support to the insured family when he is not around with his family. If you are convinced for investing in life insurance you should check things to know before buying Life insurance. Here I have mentioned Max Life Insurance policy details, benefits, and features.

The life covered backed by the company is extended up to 1 crore. The highlight settlement ratio of the company is 96.95% respectively. This firm provides various life insurance plans to cater to the customers’ requirements. In the event of sudden dismiss of the insured the company will offer full claim to his beneficiaries after the maturity period. This is not the end of the Max Life Insurance policy details. Below, I have mentioned the eligibility criteria and features.

MAX Life Insurance Policy Eligibility Criteria

- The minimum age the applicant is 18 years.

- The maximum age of the applicant is 60 years.

- An applicant must be employed or self-employed.

Max Life Insurance Policy Features

- The maximum tenure is offered by this company is 35 years.

- The company has set 25 Lac the minimum sum assured money.

- The company doesn’t set a limit for the maximum sum assured money.

- There will be no assets provided to the beneficiaries in the event of suicide of an insured

Must Read: How to Check Bike Insurance Online | Zero Depreciation Car Insurance

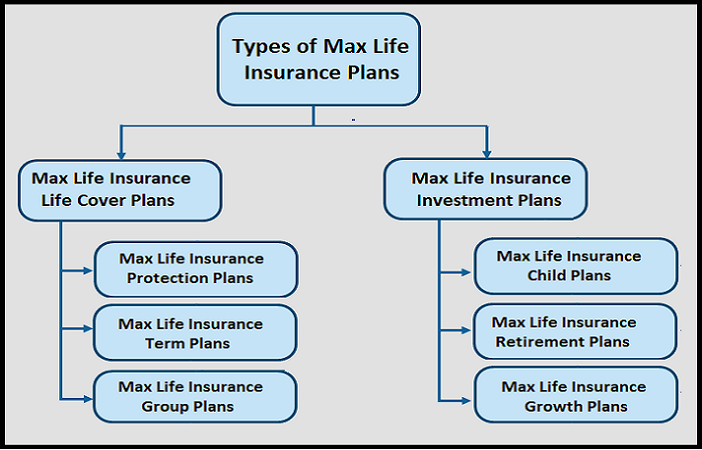

Max Life Insurance Policy- Types

-

Max Life Term Insurance Plan

This plan offers coverage to insured and provides a lump sum amount to the nominee in the event of the death of the policyholder. After purchasing, you can check the max life insurance policy status by contacting customer care. Top Term Plans offered by Max life term insurance are listed below.

- Max Life Online Term Plan Basic Cover

- Term Plan Cover Plus monthly income

- Life online term plan life cover plus increasing monthly income

-

Max Life Protection Plans

Under this plan, you will get coverage against death, disability, diseases. This is one of the best life insurance plans it allows you to live with peace of mind with your family. You can check the Max Life Insurance policy details online by login at their portal. Top Max Life Insurance Protection Plans are listed below.

- Max life cancer protection plans.

- Super Term Plans.

- Max life premium return protection plan.

-

Max Life Child Plans

These plans have come with one aim to save children’s future. You can save money for your child’s education, marriage, and other major expenses. Below are the best child plans offered by Max Life Insurance

- Max Life Future Genius Education Plan.

- Sikhsha Plus Super Plan.

-

Max life Retirement Plans

These plans are for the individuals who want to spend their life independently, after retirement. To check details of Pension Plans offered by Max Life Insurance you can check their website

- Max Life Forever Young Pension Plan.

- Guaranteed Lifetime Income Plan.

- Max Life Perfect Partner Super Plan.

-

Max Life Growth Plans

These plans are for individuals who want to increase growth through the calculated investment. It is a form of indirect investment, your money is invested in the stocks market and managed by professional investors. After taking these plans you can do Max Life Insurance Policy Status Check and details by contacting their contacting customer care. List of Growth Plans is below

- Max Life Fast Track Growth Plan

- Platinum Wealth Plan

- Max Life Maxis Super Plan

-

Max Life Group Plans

These plans are designed for organizations who want to give life coverage benefits to their employees. Here’s a list of group plans

- Max Life Group Term Life Platinum Assurance Plan

- Gratuity Premier Plan

- Max Life Group Super Life Premier in Lieu of EDLI

- Group Super Life Premier

- Max Life Group Credit Life Secure

- Pradhan Mantri Jeevan Jyoti Bima Yojana

- Max Life Group Credit Life Premier

Must Read: Best General Insurance Companies in India | Aviva i Term Smart Plan

Max Life Insurance Policy- Benefits

- This company has trusted by the millions of individuals.

- The customers’ service is round the clock available for the customers.

- Provide exceptional investment advice and life coverage services.

- The claim settlement process is very simple.

Max Life Insurance Policy Check Status Statement & Payments

If you want to check the Max Life Insurance Policy Status, feel free to contact their customer service through a toll-free number or email. Or you can log in at their portal customerlogin.maxlifeinsurance.com to check max life Policy Status online.