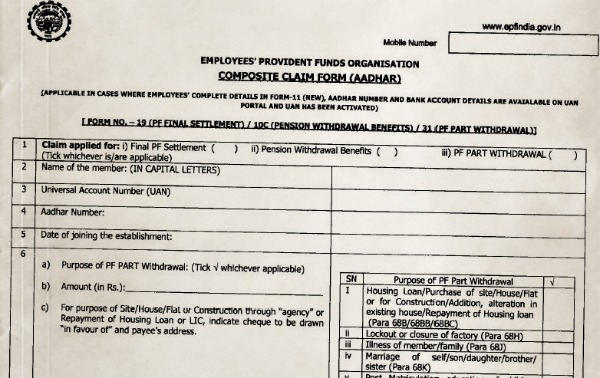

EPFO Composite Claim Form

Employees’ Provident Fund (EPF) is a government-sponsored retirement programme to which every employee in the public and private sectors makes a monthly contribution equal to a portion of their pay. The company likewise contributes equally to each employee’s EPF account.

After leaving a job, an employee may also ask for the EPF account’s ultimate settlement. To withdraw money from the EPF account for the final settlement, he must complete Form 19.

One of its most recent updates is the addition of an online composite claim form submission option. This process used to take forever and be weighed down by paperwork. This occurs shortly after EPFO eliminated the requirement for partial withdrawals to include supporting documentation and certificates by introducing a composite claim form for withdrawal requests.

Read: Sukanya Samriddhi Yojna

Types of EPF composite claim form

Two types of composite claim form are-

- Composite Claim Form (Aadhaar)

If the EPF database has your Aadhaar number, you can utilise this claim form. Additionally, you need to meet the requirements listed below.

Number UAN (Activated)

Your Aadhaar number has been seeded in the EPF database, together with your bank account information and IFSC.

The PAN number was provided.

The EPFO can authenticate your application by issuing an OTP to the registered cellphone number thanks to Aadhaar. Therefore, the employer does not need to approve this application. This form may be delivered straight to the local PF office.

Most employees have been requested for their Aadhaar numbers by the EPFO. The Aadhar number of employees must be approved by the employers. Aadhaar numbers are now required in order to complete the EPF membership form. Older members can submit their Aadhar numbers online as well, but your employer must accept them. The EPF website offers a PDF version of this form for download.

- Composite Claim Form (Non-Aadhaar)

If your Aadhaar number isn’t listed in the EPF database, you must utilise this form. You must provide more details on this form. For instance, you must also provide your birthdate, PAN, and bank account number. For people who want to withdraw funds from their really old EPF account, this form is helpful. Such old EPF accounts don’t have the UAN and Aadhaar is also not needed.

However, you have to get this form approved by the employer. You can download the PDF copy of the EPF composite claim form (Non-Aadhar) from thewebsite itself.

Who ought to utilise this?

The Composite Claim Form (Aadhar) will replace Claim Forms No. 19, 10C, and 31, as well as Forms No. 19, 10C, and 31 (UAN) (UAN). If a member’s entire Form 11 (New), Aadhar number, and bank account information are available on the UAN Portal and UAN has been activated, then the Composite Claim Form is applicable. Such members may submit this form directly to the relevant EPFO office without the employers’ attesting the claim form.

To make the submission of composite claim forms by subscribers simpler, the Composite Claim Form (Non-Aadhar) will take the place of the current forms 19, 10C, and 31. The new Composite Claim Form (Non-Aadhar) must be submitted to the relevant EPFO office with the attestation of employers.

| Purpose | Eligibility | Limit |

| Medical Emergency for member/spouse/parent/children | Any PF Member | Lesser one of employee’s share plus interest or 6 times of the monthly salary |

| Construction/Purchase of New House | Employee must have served min 5 years | 90% of the PF Balance |

| Renovation of House | Can be withdrawn after 5 years from the construction of house | 12 times of the employee’s monthly salary |

| Repayment of Home Loan | Employee must have served for min 3 years | 90% of the PF Balance |

| Wedding of member/sibling/children | Employee must have served for min 7 years | 50% of employee’s share plus interest |

EPF Withdrawal rules

The Employees’ Provident Fund is an investment plan established with retirement in mind. Withdrawal ought to be avoided unless an emergency arises. However, if a member wishes to withdraw money from his EPF account, he should be aware of the following guidelines:

- Withdrawals from Provident Fund made within five years of account opening are subject to tax.

- When you switch employers, you don’t need to withdraw your provident fund because doing so online makes it simple to transfer it to a new account.

- According to the regulations, you are not permitted to take money from your Provident Fund while you are still working.

- Employee Provident Fund loans (partial withdrawals) are available.

The Indian government amended the employee provident fund in 2016 in response to early PF withdrawals made by employees. The following are the primary changes to the EPF withdrawal rules:

- After the age of 54, 90% of the EPF balance can be withdrawn.

- A person who quits a job can take 75% of their provident fund balance after one month of unemployment and the remaining 25% after two months.

New EPF Composite Claim Form- FAQs

- EPF Composite Claim Form: What Is It?

Answer-All previous UAN- or non-UAN-based claim forms, including Form 19, Form 10C, and Form 31, are replaced by the new EPF Composite Claim Form. For PF Final Settlement, EPS Pension withdrawal, and PF Partial withdrawal, respectively, Forms 19, 10C, and 31 are currently accepted.

- What is the new composite claim form based on Aadhaar?

Answer-When a member’s entire Form-11 (New) information, Aadhar number, and bank account information are available on the UAN Portal and UAN has been activated, the Composite Claim Form (Aadhar) is applicable.

- Can I electronically submit a Composite Claim Form?

Answer-The Aadhaar composite claim form can be used to submit your claim online.

- What address should my EPF Composite claim form be sent to?

Answer-After that, the claim form can be filed to the relevant EPFO office in accordance with the PF withdrawal laws without the employer’s attestation. You will also need to include a cancelled check with your name on it.

- How do I get my PF money from the old employer back if I join the new one?

Answer-A member must always submit Form 13 when switching employers to move their PF account from their old employer to their new workplace (R). As an alternative, the member may submit a transfer request online by accessing the EPFO portal using a valid UAN and password.