Best Investment Options for Salaried Person

All income groups are concerned about selecting the finest investment solutions for wealth management. Even though saving money is important for a solid financial future, you shouldn’t rely solely on your savings. You can choose from a variety of long- and short-term investing options depending on your objectives and level of risk tolerance. Many of India’s best investment options provide supplementary returns in the form of assured additions. Even though starting to invest in your early to mid-20s is desirable, there are no drawbacks to starting later. As long as you make wise investments, you can prevent inflation from eroding the purchasing power of your money.

Read: How to Become Smart investor?

Top 7 Best Investment Options for Salaried Person

Here Are The Best Investment Options for The Salaried Persons-

1. Mutual funds

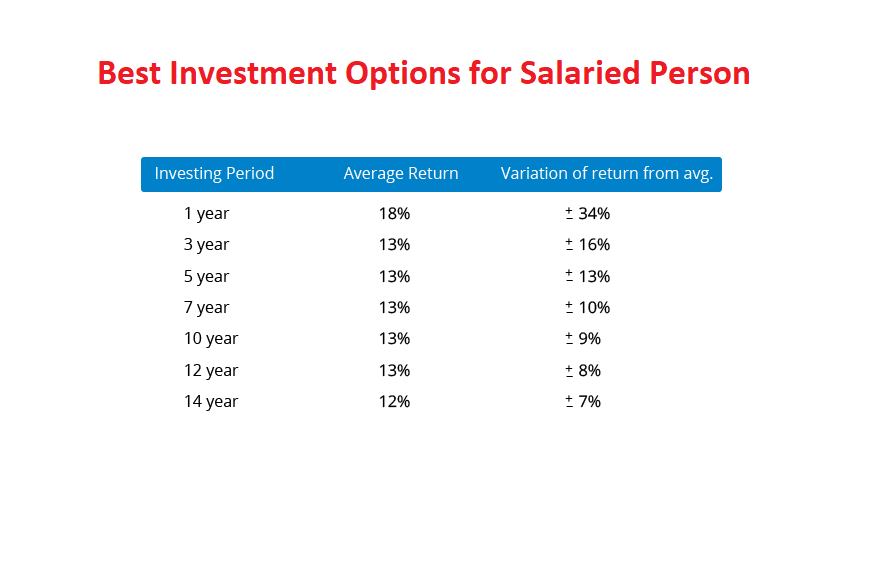

Mutual fund investments are exposed to market risk, thus one should consider the risk before making an investment. Mutual funds might develop into your ideal investment possibilities if you comprehend the market and its risks and how to use them to multiply your money. You can design a portfolio of assets based on your preferences, whether you choose to invest for the long run or the short term.

Monthly systematic investment plans or systematic withdrawal plans can be good investment choices if you desire a stable income from mutual funds but have reduced risk tolerance. If you want to invest in India and want a large return, it may also be a good option for investment for salaried persons..

2. Public Provident Fund(PPF)

This option is also suitable for salaried persons. Due to the government’s sovereign guarantee, PPF is one of the safest investment options available for salaried workers. Tax deductions are also available for PPF investments under Section 80C. PPF now offers 8% annual compound returns with a 15-year lock-in period. On the basis of the returns on government bonds, the Ministry of Finance does, however, review the interest rate every financial quarter. After the first 15-year term has expired, you can also extend your investment time with 5-year blocks. The maximum amount that can be invested in PPF in a fiscal year is Rs. 1.5 lakh, while the minimum is Rs. 500.

The major flaw with the PPF is its lack of liquidity. Only as of the 7th FY is partial withdrawal allowed.

After the fifth fiscal year, the account may be prematurely closed for higher education or medical treatment of serious illnesses or life-threatening conditions.

3. Invest in bank FDs.

Fixed deposit investments are preferred by people seeking retirement investment choices because they allow them to deposit money with banks for a predetermined amount of time (from 15 days to five years & above). This provides an interest rate that is higher than a conventional savings account. When it matures, the investor receives a return that is equal to the principal borrowed plus any interest accrued throughout the term. The finest short-term investing options are FDs because they are secured investments.

For FDs, the majority of banks typically offer annual interest rates between 3 percent and 7 percent. People with salaries who seek higher yields can spread their FDs across many banks as long as their total deposits and fixed accounts don’t go above the Rs. 5 lakh limit in each bank. So, for a person on a salary, this is actually the best investing option. In accordance with Section 80c, salaried individuals may also open tax-saving FDs to reduce their income tax. However, only your principle amount will be eligible for a tax deduction. The amount of the interest must be taxed.

Read: Best investment Blog in India

4. National Savings Certificate (NSC)

Investments in NSC have a five-year lock-in period and are eligible for Section 80C tax deductions. Investments in NSC are backed by the government because the Finance Ministry is in charge of managing them. The interest rate is evaluated every quarter, and Section 80C considers the annual interest component to be reinvested. Thus, only the interest component earned in the last financial year of investment is taxed as per the tax slab of the investor. This gives NSC an edge in terms of tax efficiency when compared to bank fixed deposits.

5. ULIPS

A Unit Link Insurance Plan (ULIPS) is a plan that offers customers both investing and insurance benefits. ULIPS are only intended for risk-taking investors because they are market connected. A portion of the premium is used to provide insurance coverage to the policyholder, while the remainder is invested in different equity and debt strategies. The assigned premiums are used to purchase units in accordance with the fund type based on the current NAV. The scheme’s per-unit value, or NAV, is disclosed on a regular (daily) basis. Based on the state of the market and the performance of the fund, it differs from one ULIP to another.

Depending on their tolerance for risk, policyholders can choose between different fund types (equity or debt) or a combination of both. Before choosing this investing choice, a salaried person should carefully consider the risks associated with ULIP plans.

6. Investment in gold

The most popular traditional investment option available in India is gold because it has high liquidity, doesn’t require any paperwork (for direct gold purchases), and offers long-term returns that are above inflation.

During equity market downturns, the gold investment provides a good hedge as the prices shoot up. Gold may also be a great investment to pass on to the next generation who might not have such luxuries to find gold in abundance.

A few of the physical gold investment alternatives in India include purchasing jewellery, gold coins, or bars, as well as paper gold investment options like gold exchange-traded funds (ETFs), equity-based gold funds, etc. In India, gold investments offer moderate returns with low risk.

7. Bonds

Companies and governmental entities, like individuals, require money for social programmes and infrastructure development, thus they sell bonds to the public markets.

In other words, bonds are fixed-income investment choices that serve as collateral for a loan that a shareholder makes to a governmental or corporate borrower.

The fact that the terms for fixed interest payment, loan principal, and tenure are all covered in the bond specifics makes them one of the top investment plans in India.

As a result, it guarantees both the security of your money and an additional return.

Additionally, the relationship between bond prices and the current interest rates is inverse. It implies that these prices decrease and vice versa as interest rates rise so would be a great option for investment for salaried persons.

Read: All Time Best investment Option in India

Best Investment Options for Salaried Person in India- FAQs

- How may a salaried person reduce their taxes?

Answer-There are a variety of measures that you might use to reduce your taxable income. For instance, section 80C allows you to annually save Rs. 1.5 lakhs.

- Can a person on a salary make stock investments?

Answer-Salary workers can now open trading and Demat accounts instantly with reputable stockbrokers like Zerodha, Angel Broking, etc., and begin investing the same day.

- Government employees, may they sip?

Answer-Mutual funds, including the SIP style of investment, have no dollar limits. Therefore, there are no barriers or legal violations preventing government employees from investing in the mutual fund market.

- How can I save over ten lakhs in taxes?

Answer-The additional taxable income reduction allowed by Section 80C investments is up to Rs 1.50 lakh.

- Can a housewife make stock market investments?

Answer-Indian housewives can select them to invest money in a variety of instruments, including bonds, commodities, etc.