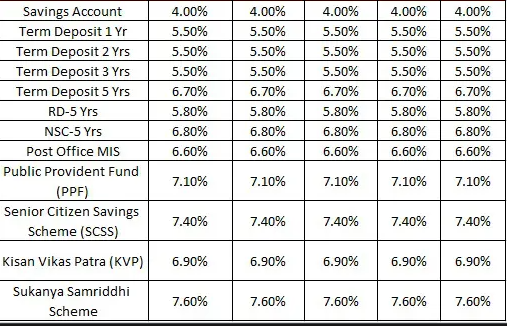

Post office Interest Rates Table

Post Office interest rates Small Savings Plans have recently been very low. The most recent post office interest rates, which are valid from October 2022 to December 2022, have been released by the Ministry of Finance. We could see that they had raised the interest rates on a few small-scale savings plans. This page will provide updated post office interest rates for small savings plans that are valid from October 2022 through December 2022.

Let’s now briefly review the features of the Post Office Small Savings Schemes. You will be better able to select the ideal product for you thanks to this.

Read: PM office Interest Rates

Post Office Monthly Income Scheme(POMIS)

- Unusual programme that guarantees a fixed monthly income on the investor’s lump sum investment

- The MIS account may be opened by any resident person in a single or joint holding pattern. A minor may invest in this plan as well. The youngster may even manage the account if he is older than 10 years.

- By aggregating the balances in all of the accounts, investors can have several accounts with a maximum investment of Rs. 4.5 lakh. All holders will contribute equally to joint accounts. Using the previous illustration, Mr. Suresh could only create a joint account with his wife for a maximum of Rs. 2.5 lakh.

- In addition to providing liquidity, the Post Office Monthly Income Scheme allows investors to withdraw their deposits after one year. However, there will be a 2% penalty on the deposit if it is withdrawn within the first three years, and a 1% penalty after that.

- Under the Monthly Income Scheme of the Post Office, the minimum investment amount is Rs. 1000, and the maximum investment amount is Rs. 4.5 lakhs for a single holding account and Rs. 9 lakhs for joint accounts.

- Accounts can be moved from one post office to another nationwide.

Post Office Fixed Deposits(FD)

- In your own person or jointly with another account holder, you are permitted to open an unlimited number of Post Office FD accounts.

- Interest on Post Office FDs is compounded quarterly and due annually. Additionally, the Indian government evaluates post office FD rates every three months.

- The deposit requirement is Rs 1,000. Additionally, there is no upper restriction on the total deposit amount. The deposit, however, can only be done in multiples of Rs 100.

- Only fixed tenure investments in Post Office fixed deposits are permitted. These FD terms range from one year to five years. You cannot invest in days or months like you may with other bank fixed deposits. You are not free to select your own investment maturity tenure in this case.

- Under section 80C of the Income Tax Act of 1961, the 5-year Post Office FD or National Savings Term Deposit is eligible for a tax deduction. A tax deduction of up to Rs 1.5 lakhs on the deposit amount is offered by Section 80C of the Income Tax Act, 1961.

- The post office fixed deposit’s interest will be taxable to the depositors. For individuals who are under 60 years old, the interest is taxed. However, for senior individuals above the age of 60, interest up to Rs 50,000 is tax-free.

Read: Post Office Monthly Income Scheme

Post Office Recurring Deposit(RD)

- Post office RDs are essentially monthly investments with a fixed 5-year term and a 5.8% annual interest rate (compounded quarterly).

- When the five-year fixed term is up, a monthly investment of Rs. 10,000 in an RD account will earn you Rs. 3,256.48.

- Small investors can benefit from Post Account RD by investing as little as Rs. 100 each month and up to a minimum of any amount in multiples of Rs. 10. The investment has no maximum amount.

- Additionally, two adults may open a joint account. It is also possible to open the account in a minor’s name. Furthermore, multiple accounts may be created.

- Transferring RD from one post office to another is possible.

Post Office Fixed Deposit(FD)

- Opening an account requires a minimum deposit of Rs. 500.

- A minor (over 10 years of age) or a guardian on behalf of a minor may open an account.

- The minimum balance that must be kept in an account is INR 500. If the minimum balance is not kept, a maintenance fee of INR 100 will be deducted on the last working day of each fiscal year, and if the account’s balance falls to zero after the maintenance fee has been deducted, the account will be closed automatically.

- There is a check facility and an ATM.

- From the financial year 2012–13, interest earned is exempt from tax up to INR 10,000 per year.

- Accounts may be transferred between post offices.

- There is a facility for intra-operable netbanking and mobile banking.

- Through intra-operable netbanking and mobile banking, it is possible to transfer money between Post Office Savings Accounts, stop checks, and transaction views online.

Post Office Interest Rates Table Oct 2022

Note: All interest rates shown below are as on 1st Oct 2022

| Tenure | Normal Citizen FD Rate | Senior Citizen FD Rate |

|---|---|---|

| 1 year – 1 year | 5.5% | 5.5% |

| 1 year 1 day – 1 year 11 months 29 days | 5.5% | 5.5% |

| 2 years – 2 years 11 months 29 days | 5.5% | 5.5% |

| 3 years – 4 years 11 months 29 days | 6.7% | 6.7% |

Post Office Interest Rate Returns Table Based on Investment Amount

| Investment Amount | For 3 years with interest of 5.5% | For 5 years with interest of 6.7% |

|---|---|---|

| ₹ 50,000 | ₹58947 | ₹69832 |

| ₹ 1 lakh | ₹117895 | ₹139664 |

| ₹ 2 lakh | ₹235790 | ₹279328 |

| ₹ 5 lakh | ₹589474 | ₹698319 |

| ₹ 10 lakh | ₹1178949 | ₹1396638 |

Post office Interest Rates Table 2022- FAQs

- Interest in the post office is it rising in 2022?

Answer-For the quarter of July-September in FY 2022-23, the government has once more maintained the interest rates for the modest savings programmes at their current levels. This information was released by the Ministry of Finance in a circular dated June 30, 2022.

- Will my money double in five years?

Answer-Long-term mutual funds can provide rates of return between 12% and 15% annually. To double your money with these mutual funds, it might take five to six years. KVP: Kisan Vikas Patra Under the Post Office Small Savings Scheme, it falls.

- Which postal programme offers the biggest interest rate?

Answer-A 7% yearly compound interest rate is available through Kisan Vikas Patra. It is available for purchase at any post office. Once every 123 months, the invested amount doubles (10 years and 3 months). The investment can be made in multiples of 100 and has a minimum limit of Rs. 1,000 with no maximum.

- How safe is Post Office FD?

Answer-Guaranteed Profits The post office fixed deposit is one of the safest investing options because it is a government-backed savings programme and delivers a guaranteed return.