Jeevan Umang Policy Calculator

The government-owned insurance firm Life Insurance Corporation of India (LIC) is based in Mumbai, Maharashtra. It was established in 1956 and is now India’s largest provider of life insurance. There are 25 crore subscribers to the organisation.

With 8 zonal offices, 113 divisional offices, and 2,048 branch offices, LIC operates all over India. For its customers, LIC offers a wide range of insurance options. Some of the categories they offer include Aam Aadmi Bima Yojana, insurance plans, special plans, pension plans, unit plans, etc. Endowment plans like Jeevan Pragati and Jeevan Labh, money-back plans like Jeevan Tarun and Bima Shree, term assurance plans like Anmol Jeevan II and Amulya Jeevan II, and others are offered by LIC under the category of life insurance.

Read: All About Oriental Insurance Company.

Jeevan Umang Policy Calculator Plan No. 945 Information

You have assured a yearly income with the LIC Jeevan Umang policy till the policy matures or the insured life expires. This plan stands out for its long-term insurance cover that lasts until age 100! The annual income benefit begins after the premium-paying period has ended and lasts until the policy’s maturity date or the date of the insured’s death during the policy’s term.

Policyholders will also receive a lump sum payment as part of the sum assured upon maturity and death in addition to this survival benefit each year.

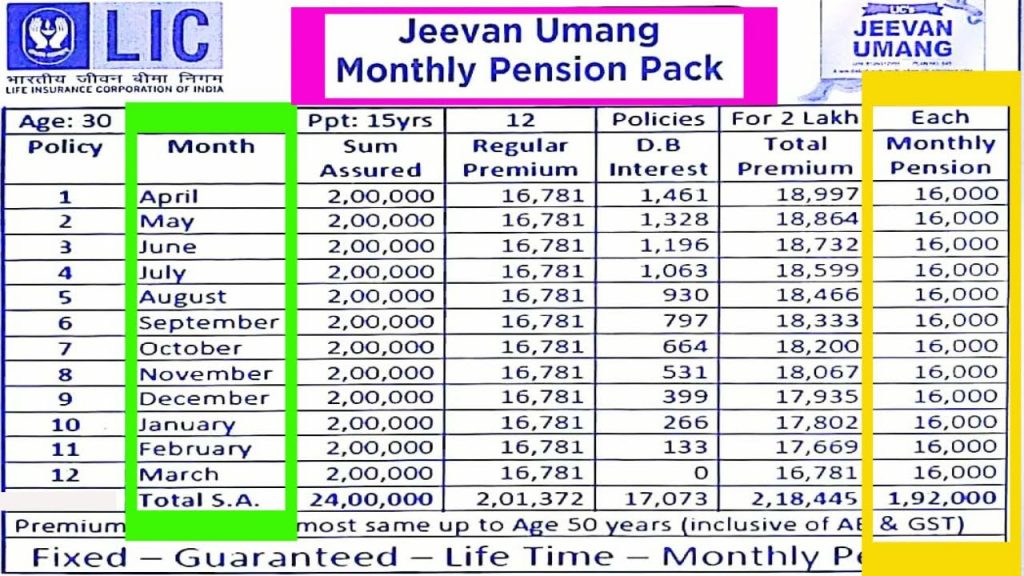

Jeevan Umang Policy Calculator 2023 Policy Plan 945 Premium Calculator Online

The LIC Jeevan Umang calculator is an online tool that provides information about the premiums for the cover you have selected. Policyholders can choose the most comprehensive insurance for themselves at a reasonable premium cost based on the results. The maturity value and death benefit amount that you and your family would be entitled to on the appropriate occasions will also be computed using the LIC Jeevan Umang 945 premium calculator.

LIC Jeevan Umang Policy Calculator Plan 945 Premium Calculator’s Features

- The tool uses the selected basic sum assured, policy term, premium-paying term, purchaser’s age, gender, and information on smoking to determine the premium.

- In order to enable the selection of the most appropriate and inexpensive choice, the premiums payable for monthly, quarterly, half-yearly, and yearly modes are displayed.

- Its dependability is demonstrated by the fact that the tool is available online at the official LIC of India website.

- Based on your inputs, the LIC Jeevan Umang Maturity calculator provides fast results.

- It does away with the necessity for intermediaries, which lessens instances of miscommunication or misselling.

Requirements for the LIC Jeevan Umang Policy Calculator 2023 Calculator

The following is a list of the LIC Jeevan Umang Plan’s eligibility requirements:

- A 90-day minimum entrance age (completed)

Maximum Age-

- 55 years old is the maximum entry age for policies with a 15-year term.

- if the policy period is 20 years, 50 years.

- 45 years in the case of a 25-year policy term

- if the insurance period is 30 years, 40 years.

- Age at maturity: 100 years old as of the most recent birthday

- Regularity of premium payments: annually, biannually, quarterly, and monthly

- The minimum amount guaranteed: Rs. 2 lakh

- No maximum amount is guaranteed.

LIC Jeevan Umang Policy Calculator Table No. 945- Benefits

Survival Advantage

The policyholder will receive an annual payment of 8% of the Basic Sum Assured upon completion of the premium payment term. This money is payable year until he reaches the age of one hundred or dies, whichever comes first.

Maturity Advantage

The policyholder will receive the Basic Sum Assured + Simple Reversionary Bonus + Final Addition Bonus upon turning 100 years old. The Sum Assured on Maturity is the term used to describe this.

Loan Service

Following the policy’s acquisition of a Surrender Value, you will be qualified to borrow money against it. Only when the premiums for three full years have been paid will this plan receive a surrender value. The terms that were in effect at the time the loan was taken would determine the loan amount and interest rate.

Death Benefit

The nominee will get a refund of any premium payments made if the policyholder passes away prior to the “Risk Commencement Date.”

If the policyholder dies after the “Risk Commencement Date,” the nominee will receive the Sum Assured on Death.

The highest of the following is known as the Sum Assured on Death:

10 times the Basic Sum Assured under the Annualised Premium plus the Simple Reversionary Bonus and the Final Addition Bonus

Never will the Death Benefit be less than 105 percent of the total premiums paid.

Taxes, Rider premiums, and any additional premium due to underwriting decisions are not included in the premiums mentioned in the Death Benefit.

Click to learn more about how this plan uses the Risk Commencement Date.

LIC Jeevan Umang Policy Calculator 2023- Riders

- The Accidental Death and Disability Benefit Rider from LIC provides the nominee with an additional sum assured in the event that the insured dies accidentally while the policy is in effect. Anytime during the policy term, this rider may be selected by paying an additional premium above the regular policy premium.

- The benefit of the LIC’s New Term Assurance Rider increases in the event of death. When the policy is issued, you can choose this kind of rider by paying an extra fee. This rider provides coverage for 35 years or until the policy anniversary at which the insured is 75 years old, whichever comes first.

- Accident Benefit Rider: This rider is an additional premium that can be chosen in addition to the base policy premium. You can opt for this rider anytime within the policy paying term. The rider benefit is paid to the nominee in the event that the insured dies accidentally within 180 days of the accident date.

- You can choose the New Critical Illness Benefit Rider at the beginning of the policy period by paying an additional premium. If you choose this rider, you will get the critical illness sum assured if you are later diagnosed with one of the 15 critical illnesses listed in the policy rider.

Read: How To Renew New India Assurance Policy Online?

LIC Jeevan Umang Policy Calculator – FAQs

- Is LIC Jeevan Umang good plan?

Answer-The insurance plan is a godsend because it provides 100 years of coverage, or for the duration of one’s entire life. At the end of the insurance term, 8% of the Sum Assured is paid each year as money back on survival. Under this plan, a large Sum Assured is offered.

- Jeevan Umang: Is it taxable?

Answer-Tax advantages: In accordance with Section 80C of the Income Tax Act of 1961, the premiums paid for the LIC Jeevan Umang policy are not subject to income tax. The maturity amount is likewise exempt from taxes under Section 10 of the law (10D).

- What is Jeevan Umang’s interest rate?

Answer-The relevant interest rate for a loan approved during the 2016–17 fiscal year is 10% per annum, payable once every six months for the duration of the loan.

- Is Jeevan Umang able to guarantee profits?

Answer-Customers of Jeevan Umang can be sure of guaranteed returns and that their money won’t be invested in equity markets because the insurance policy is not linked.

5.Jeevan Umang or Jeevan Anand, which is superior?

Answer-LIC While Jeevan Umang is a participating insurance as well, it is a whole-life assurance plan with coverage up to age 100 as opposed to Jeevan Anand. After the period of premium payments is over, the plan offers yearly survival benefits.