LIC Surrender Value Calculator

Lic Surrender Value Calculator helps to calculate the surrender value of lic of India.

In exchange for a little sum known as “Premium,” which is to be paid by the insured customer to the insurance company on a regular basis, the insurance company promises to pay the maturity benefit to the insured or the death benefit to the insured’s nominee under the terms of a life insurance policy.

The LIC surrender value calculator of a life insurance policy from LIC is determined by multiplying a single premium by 75% of the remaining term till maturity or total term.

When a term assurance policy has an increasing maturity date, the lic surrender value calculator is determined by multiplying the single premium by 80% of the remaining term until maturity, or by the remaining term times the average of the effective sum assured at surrender and the effective sum assured at maturity, or by the average of the initial sum assured and the effective sum assured at maturity.

The LIC Surrender Value Calculator: What Is It?

An online tool called the LIC surrender value calculator can assist you in learning the general specifics of your LIC policy surrender. You may instantly determine your LIC surrender value by entering a few pieces of basic information about your policy.

- Name and Registered Mobile Number of the Policyholder

- The Plan’s Name, Policy Term, and Number of Paid Premium Installments Amount of the Premium Mode of Payment

- Total Number of Policy Years

- The calculator’s displayed result is a rough estimate, so the actual sum could be different. The method of surrender value can also affect the calculation.

Read: Best Startup Idea for Students

Types Of LIC surrender value

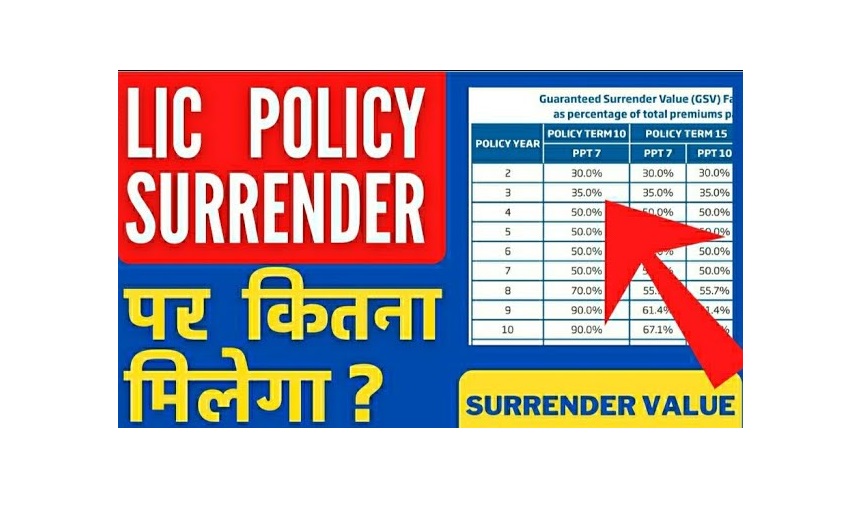

Guaranteed surrender value-

The amount that the insurance company guarantees to pay in the event that the policy is surrendered within the policy term after the policy has acquired a surrender value is known as the guaranteed surrender value. A specified proportion of the total premiums paid, excluding any additional premiums for riders, is often the guaranteed surrender value. Depending on the policy term and the year you are surrendering the policy, percentages may change. With the conditions of the policy, percentage or the surrender value factor rises. This implies that as the policy approaches maturity, the percentage applicable will increase.

Guaranteed surrender value = Surrender value factor X Total premiums paid

Special surrender value-

The non-guaranteed sum that is more than or equal to the guaranteed surrender value is known as the special surrender value. The amount of premium instalments you have paid, the length of the policy, and the bonus accumulated will all affect the unique surrender value (if any).

Calculating special surrender value is as follows:

Basic sum assured multiplied by the number of premiums paid or due plus cumulative bonuses equals special surrender value. Factor X that applies to surrender value

The following guidelines must be followed by a policyholder for LIC policy surrender:

- A LIC policyholder should pick up Form No. 5074, Application for Surrender/Discounted Value, from the closest LIC branch; Form No. 5074 should be completely filled out and filed with the pertinent documents;

- The LIC would carry out the process of surrendering the policy after receiving the paperwork and the supporting papers;

- The surrender value will be directly transferred to the policyholder’s bank account once all policy surrender procedures have been followed and the surrender request has been approved.

How Is the Surrender Value Calculated?

The surrender value can be determined in one of two methods. The steps listed below can be used by Life Insurance of India (LIC) policy holders to obtain their life insurance policy’s surrender value online:

- The first thing is After accessing licindia.in as a new user, register yourself.

- After logging in, select “Enrol Policies” from the left menu.

- Click “Proceed” after visiting “Click to Enrol New policies.”

- Click “Enrol your policy,” providing the policy number and the amount of the premium paid.

- Select “View Enrolled policies” after registering the insurance.

- Under “Loan and Bonus” Tab, click “Click for information.” 7. The built-in application will display the surrender value.

LIC Surrender value calculator jeevan anand

Using the online LIC New Jeevan Anand Premium and Maturity Calculator, it is simple to determine the premium and maturity amount for the LIC New Jeevan Anand plan. The LIC New Jeevan Anand Premium Calculator is a beautiful online tool that appears in a tabular format and asks you to enter a few simple facts. The information you must enter includes your desired sum assured for the LIC New Jeevan Anand Policy, your age, and the appropriate policy term. You must also include your name, your contact information, and, if necessary, your choice of rider. After entering all the necessary data, select the “calculate” option to find out the premium.

The premium amount for the entered details is immediately calculated by the LIC New Jeevan Anand Premium Calculator. The premium amount for various premium payment methods can also be calculated. You may quickly determine the maturity amount of the policy depending on the age and policy term using the Maturity Calculator for the LIC New Jeevan Anand Plan.

How can I use the calculator for the LIC New Jeevan Anand premium?

It is simple to calculate the premium using the LIC New Jeevan Anand Premium Calculator. You can instantly receive the reports by following 3 easy actions. The actions are:

- Activate the calculator

- Mention the desired amount of the money assured and the duration of the insurance.

- Mention the insured person’s age.

- Click compute after mentioning all of these elementary details. The digital platform will compute the outcome right away and display it to you.

Read: Top 10 Loan App for Students

LIC Surrender Value Calculator- FAQs

- When I resign my LIC coverage after five years, how much money would I receive?

Answer-90% of the whole maturity amount is supplied if the insurance bearer has paid premiums for more than 4 years but less than 5 years. The policyholder receives 100% of the sum assured if they have been paying premiums for more than five years (maturity amount).

- Is there a branch where I may cancel my LIC policy?

Answer-Only the branch where it is currently being served is able to accept the LIC policy for surrender (i.e. Servicing Branch). So before giving it up, you need to adjust the policy servicing branch.

- Maturity Value: What Is It?

Answer-The amount owed and due to be paid to the holder of a financial obligation as of the obligation’s maturity date is its maturity value.

- What form is needed to relinquish a LIC?

Answer-The person who is legally entitled to receive the policy money must notify the Service Branch about the policyholder’s passing. The following are the requirements for the claim: Claim Form ‘A’in Form No.3783. If policy has run for 3 years or more from date or risk, claim form no.3783A may be used.

- Can I look up the surrender value of LIC online?

Answer-Any insurance company website has an easy-to-use LIC Surrender value calculator. A person only needs to enter some basic information, like his name, phone number, plan type, term length, number of instalments, method of payment, required premium, and length of time the policy was in effect.