IFSC Full Form

IFSC Full Form is Indian Financial System Code. You will always require the IFSC code of the appropriate bank whenever you want to use IMPS, NEFT, or RTGS to transfer money to another bank account. The IFSC can be found on the first page of the account holder’s passbook or on the back of the check. You are aware of the rationale behind having an IFSC, but are you familiar with its full name? The Indian Financial System Code, or IFSC in its complete form, differs from bank to bank. When someone transfers money to a bank, an 11-digit alphanumeric code that identifies the bank is used. So let’s examine an IFS code in its whole and determine what each character in the code means.

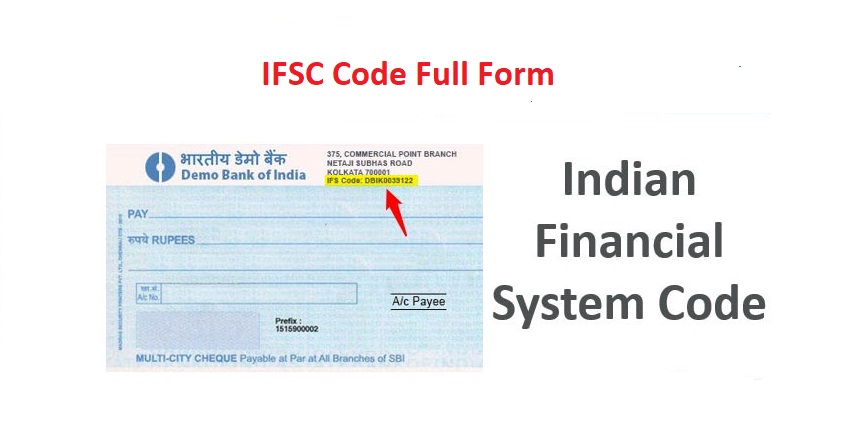

IFSC Full Form- India’s Financial System Code (IFSC)

The acronym IFSC stands for Indian Financial System Code. Indian electronic financial transfers are made easier by this 11-character alphanumeric code. It is used to identify and categorise every bank branch in India. An individual can easily recognise a bank and its branch using the provided IFSC code. The chequebook makes special reference to this code.

Each bank branch that participates in India’s two primary payment and settlement systems has an IFSC code that uniquely identifies and categorises it:

- The Real-Time Gross Settlement (RTGS).

- The National Electronic Fund Transfer (NEFT) systems.

RTGS (Real-Time Gross Settlement)

The recipient bank gives the sending bank specific transfer instructions. Since the payment is gross, each transaction is carried out separately. These payments are non-refundable and final.

National Electronic Fund Transfer System (NEFT)

The Reserve Bank of India owns and controls the National Electronic Fund Transfer System (NEFT), a centralised nationwide payment system ( RBI). Money can be effortlessly transferred between banks all around India. To allow a customer to transfer money to another party, a bank branch needs to be NEFT-equipped.

The primary distinction between NEFT and RTGS is that, in contrast to RTGS, monies are moved in batches using NEFT. This is why hourly intervals are specified, and the settlement is allocated to one of them.

IFSC code Structure & Full Form

- The 11-character IFSC code is long.

- The bank’s name is revealed by the first four letters, and the branch number is revealed by the final seven letters.

- The bank name is indicated by the IFSC code SBIN0000738 in this SBIN, while the branch number is shown by 0000738.

- The IFSC Code is required to make a cash transfer using an online and digital technique, such as NEFT or RTGS, from one bank branch to another branch.

The importance of the IFSC code

- For the purpose of identifying and categorising banks and their branches that offer RTGS, IMPS, and NEFT facilities, RBI gives the IFSC Code.

- RBI can easily and accurately verify and assess financial transactions thanks to the IFSC code.

- RBI can manage and handle all IFSC code-based online banking transactions, including RTGS, NEFT, and IMPS.

Read: TDS Full Form

Uses of IFSC

- When making IMPS, the Indian Financial System Code is required.

- As part of n NEFT money transfer, you must also enter the IFSC.

- The IFSC of the specific branch to which the funds are to be sent must be written down during RTGS.

- When adding a beneficiary to your banking mobile app, you will always require an IFSC. Only you will then be able to make payments to the beneficiary’s account.

- The IFSC increases online transaction security and lowers fraud.

- IFS code will take care of finding the bank’s branch, saving you time and effort.

Let’s now examine how the IFSC functions.

One must enter the account number and branch-specific IFSC code when initiating a fund transfer to a specific payee. The money is transmitted to the account holder after the remitter submits these details, and IFSC helps prevent any errors in such transactions.

In addition to financial transfers, IFSC codes can be used to use online banking to buy mutual funds and insurance. The National Clearing Cell of the Reserve Bank of India (RBI) keeps track of all transactions, and the IFSC code enables error-free fund transfers to be carried out by the RBI.

How Can One Transfer Money Using a Bank Account’s IFSC Code?

The two primary methods of fund transmission are already known to someone who is familiar with financial activities. One is the traditional method, which involves physically walking into the bank and depositing the check. The second approach is done electronically via IMPS, NEFT, or RTGS.

The traditional “going-to-the-bank” method does not require registering a beneficiary. The electronic method is, however, slightly different and far more secure.

- The person must fulfill the following conditions in order to transfer money via technology:

- The person must sign up for the bank’s online banking service.

- For transactions with third parties, you must register. (Take note that the term “third-party” in this situation refers to a beneficiary from a bank other than your own.)

- Registering the beneficiary’s bank account for the money transfer.

Read: RERA Full Form

IFSC Full Form- FAQs

- What purposes serve IFSC?

Answer-Indian Financial System Number, also known as IFSC, is an 11-digit alpha-numeric code used by the central bank to specifically identify bank branches inside the National Electronic Funds Transfer (NEFT) network.

- Who created the IFSC code?

Answer-The Reserve Bank of India (RBI) created the IFSC Code, also known as the Indian Financial System Code, as a special identification number for each bank branch in India.

- Is sharing an IFSC code secure?

Answer-Online banking has evolved into a secure platform for all banking transactions thanks to IFSC Codes. the special codes provided by each bank to its branches to guarantee a secure transaction.

- What number of digits are there in the IFSC code?

Answer-The IFSC is an 11-digit alpha-numeric code, the first four of which identify the bank, the fifth of which is a numeric (kept at 0), and the last six of which identify the bank branch.

- Without an IFSC code, can I transfer money?

Answer-It is impossible to identify bank accounts without an IFSC code, making it impossible to transfer money between various banks. It is still possible to transfer money inside the same bank without using the IFSC code, though.