UCO Bank Mini Statement

One of the biggest nationalized or government-owned commercial banks in India is UCO Bank, originally known as the United Commercial Bank. It was founded in 1943 in Kolkata and is a wholly-owned subsidiary of the Indian government’s Ministry of Finance. To give all of its customer’s speedy access to banking, the bank has developed cutting-edge banking services. Additionally, it offers a number of ways for its clients to get the UCO Bank mini statement. Customers will be able to check the history of their account’s transactions whenever they wish thanks to this. Customers can obtain their mini statement without necessarily going to the bank location.

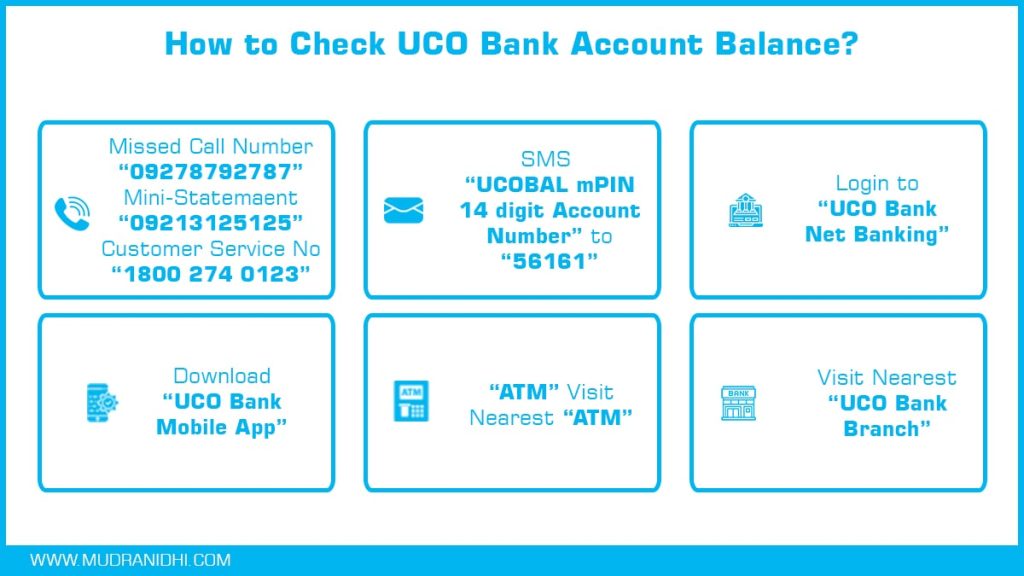

In reality, UCO Bank is a commercial bank owned by the government. Customers can check their balances, transfer money, and more through missed call service, SMS Banking, and Internet/Mobile Banking.

How to Sign Up on UCO Bank

The user must first sign up for UCO Bank mobile banking in order to access the mini-statement service. The steps for signing up for UCO Bank mobile banking are listed below:

Step 1: is to go to the UCO Bank location where your account is located.

Step 2: Obtain an application form for mobile banking activation, complete it with the necessary information, including your registered cellphone number, and send it to the branch.

Step 3: Submit the necessary paperwork, including the application form and a self-attested copy of the account holder’s Aadhaar card (which needs to be attested). At the time of application, you must also have your original documentation with you.

Step 4: Your phone number will be registered and your phone banking services will be started within two working days after you submit the form.

Ways To Get Mini Bank Statement

-

Mini-statement number

If you have an account with UCO Bank, you can contact customer service toll-free and ask for the mini statement. It’s important to remember that the call must originate from the registered cellphone number. To obtain a UCO Bank mini statement, call 1800 274 0123, which is a toll-free number.

-

UCO Bank Mini Statement By SMS

Customers can use SMS service to obtain a record of the latest three transactions from their accounts. For the user to receive the mini statement, an SMS must be sent from the registered mobile number. Send TRAN Account Number> mPIN> to 56161 to request the UCO Bank mini statement.

-

By ATM

Owners of accounts can visit the nearest bank ATM to promptly check their balance. People will need to do the following when they arrive at the nearest ATM:

- Swipe the ATM card.

- Your ATM card’s 4-digit PIN should be used.

- From the menu, select “Check Balance Enquiry.”

- The display of the ATM will show the balance of your UCO Bank Mini Statement.

-

By Internet Banking

The best place to get all of the bank’s services and amenities is through internet banking. To obtain the Mini Statement, follow the instructions.

- Go to the official United Commercial Bank website.

- To access the website for internet banking on a computer or smartphone, use this official link: https://www.ucobank.com/english/e-banking.aspx.

- To log in, enter your user ID and password.

- To access the account, choose Personal Banking and input your login information.

- Choose an account to view a statement.

- The most recent ten transactions for your account can be shown when you choose an account.

- A full statement of your account for the time period of your choice is also available for download.

-

By using the UCO mBanking App

Customers can view the mini statement with ease thanks to the bank’s new mobile banking application, which is available. Download the Mobile Banking app by going to the Apple App Store or Google Play Store. To log into the application, enter your 4-digit mPIN and the OTP sent to your registered mobile number. Get your UCO Bank mini statement by choosing the “Account Statement” option under the “Banking” menu.

-

Through Missed Call Number

Get a short statement: From your registered mobile number, call 1800 274 0123, which is a toll-free number. The call will be automatically terminated. You will soon receive a mini-statement through SMS that will detail the past five transactions you made. Benefits of UCO Bank Missed Call Assistance

- You can use the UCO Bank missed call services for a number of things, including:

- Customer account information is always accessible.

- The bank won’t impose any additional fees for the aforementioned services.

- It can aid in more effective budgeting and safeguard the user’s account from any unauthorized activity.

-

UCO Bank Mini Statement from PassBook

The simplest approach to find out the account balance is to stop by a UCO Bank branch and have your passbook updated. Every customer opening a bank account with receives a passbook. Customers can check the balance of their Account by going to the local bank branch and updating their passbook. The account holder’s full list of debit and credit transactions is detailed in the UCO Bank passbook. Account holders can also check their account balance online or on their mobile devices from the comfort of their homes.

Check Out: How FinTech Trend Grow in India

UCO Bank Mini Statement : FAQs

- How to check your UCO Bank balance by phone miss?

Answer-Give a missed call to the toll-free number 1800 274 0123 to find out the balance of your UCO Bank account. You might place a missed call to yet another toll-free number in order to obtain the short statement. - How can I get a small statement from UCO Bank?

Answer-Users can get a UCO Bank mini statement by contacting 1800 274 0123, the bank’s toll-free number. - How to use SMS to check balance?

Answer-If a user has a single account, they must SMS “UCOBAL” to 56161 from the registered mobile phone to inquire about the account balance. The primary account’s balance will be shown. - What is mPIN stand for?

Answer-Mobile Banking Personal Identification Number is referred to as MPIN. The MPIN acts as a password when a user makes a transaction through the mobile banking app. - Do you have to pay a fee to check your balance?

Answer- No, there are no fees for SMS services, however, operator may charge for this.