PLI vs LIC

Leading life insurance company Life Insurance Corporation of India (LIC) has earned the utmost respect from its clients. It is controlled by the Indian government and provides a variety of life insurance plans to its clients. The Post Office is another government-owned company that sells life insurance plans. Under the heading of Postal Life Insurance, the Post Office provides a variety of life insurance policies (PLI).

Government-backed life insurance plans such as LIC plans and postal life insurance (PLI) plans often resemble one another. It is important to compare the two insurers’ plans so that you can decide which one to select. Many of you may be perplexed while deciding which insurer is ideal for your life insurance needs because both LIC VS PLI provide a variety of life insurance policies. Let us have an analysis on the difference of pil vs lic.

PLI vs LIC- What Is Postal Life Insurance?

The Postal Life Insurance Scheme provides significant returns on premium for life insurance coverage. The 50 lakh rupee maximum sum assured granted under this scheme. Employees of Central and State Public Sector Enterprises, Central and State Governments, Government Aided Educational Institutions, Universities, Government aided Educational Institutions, Autonomous Bodies, Local Bodies, Cooperative Societies, Joint Ventures with a minimum of 10% Government/PSU stake, etc. are eligible for this policy, which is provided by the Government of India. Postal Life Insurance also oversees a group insurance programme for the Department of Posts’ “Gramin Dak Sevaks,” or Extra Departmental Employees.

Eligibility Of PLI and LIC

- Postal life insurance is available to those who work for the Department of Posts, the Reserve Bank of India, the Defense Services, financial institutions, public sector enterprises, local governments, paramilitary forces, educational institutions, extra-departmental agents, and autonomous organisations.

- Private sector employees are not allowed to purchase postal insurance.

- Except for the kid plan, the entry age for all post office PLI schemes should be between the ages of 19 and 55. The age limit to purchase a postal children policy is 45. Make sure the child is between the ages of 5 and 20.

- The PLI scheme has a minimum and maximum insurance coverage of INR 20,000 and INR 50 lakh, respectively.

- The premium is expected to be paid each month by the policyholders.

Benefits Of PLI VS LIC

- Outstanding returns: The post office’s PLI programme offers the highest level of protection together with a bonus that is larger than that of other insurers.

- Loan availability: You may use your insurance policy as collateral for loans. However, if you have an Endowment Assurance plan or a whole life insurance plan, you must wait three policy years and four policy years, respectively, before applying for a loan.

- Insurance conversion: Individuals who have purchased a whole life assurance policy may change it to an endowment assurance plan. Another Endowment Assurance plan can be substituted for the current one.

- Nomination of a nominee: Policyholders of post office insurance may designate their beneficiaries. During the term of the plan, you may also choose to replace the PLI nominee.

- Income tax benefits: The policyholder is eligible for up to INR 1.5 lakh in income tax benefits under Section 80C of the Income Tax Act on the premiums paid. 20% of the entire insurance coverage is exempt from tax.

Read: LIC Market Plus

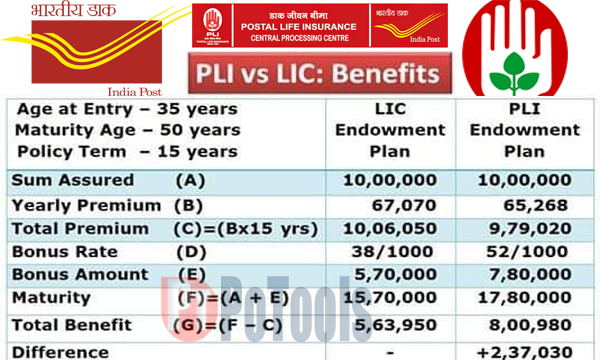

Difference of PLI vs LIC

- Plans Offered: Purchasers of postal life insurance have access to a small number of plans. At the same time, LIC provides a variety of life insurance plans on the market, enabling customers to pick the best one for their needs.

- Premium Prices: When compared to LIC life insurance products, postal life insurance premium prices are quite low. As a result, consumers looking to purchase endowment plans can choose those that will assist them earn additional benefits.

- Bonus Rates: Policyholders of postal life insurance can earn substantial returns thanks to bonus rates of at least 7%. LIC, on the other hand, only provides a bonus of 4% to 5%.

- Age Limit: LIC provides coverage for policy buyers up to 75 years of age, whereas the highest age limit for purchasing a PLI is 55 years. This contrast illustrates approaches to ensure financial stability.

- Rider Options: LIC life insurance policies include riders that include coverage for accidents, catastrophic illnesses, and disabilities. A PLI, on the other hand, is a term that only consists of life insurance and offers no other advantages.

- Sum Assured: The PLI plan’s maximum sum assured is Rs. 50 lakhs, however there is no maximum sum assured amount for LIC.

Which one is preferable, LIC vs PIL?

Your criteria determine which solution is best in every way. PLI is a better option if you want to invest in a typical endowment plan because it provides the plan at a very low premium cost. In addition, PLI’s endowment plans earn higher incentive rates than those provided by LIC. PLI is an excellent option for traditional endowment plans if you are happy with the coverage of up to INR 50 lakhs.

However, as PLI does not provide ULIPs or term insurance policies, LIC is your only option if you want to invest in one of these products. Given that you must have a term insurance policy, you should pick LIC when purchasing a good term insurance policy. Furthermore, as PLI does not provide health insurance policies or retirement planning services, you must select LIC. Last but not least, LIC outperforms PLI in terms of coverage. PLI restricts the coverage that is offered under its policies, therefore if you want a larger coverage level, you should choose LIC.

So evaluate your insurance requirements and choose. B

PLI vs LIC- FAQs

- PLI is it tax-free?

Answer-All tax advantages that apply to life insurance policies apply to investments in PLI. The premium payment is eligible for a tax exemption under section 80C, and the returns are tax-free.

- Who qualifies for PLI coverage overall?

Answer-Candidates for Postal Life Insurance must be between the ages of 19 and 40, or 45 for policies with terms of 20 and 15 years, respectively. Policyholders are not permitted to borrow money using this PLI Sumangal policy.

- Is PLI Online accessible?

Answer-If you are not a customer of India Post, you can still begin the policy purchase process online. You can find Purchase a Policy by navigating.

- Is PLI a wise choice?

Answer-Unit Linked Insurance Plans (ULIPs) and pensions are not provided by Postal Life Insurance (PLI) (ULIP). For those who qualify, it is a good alternative because it offers better returns and has lower costs than similar life insurance policies from other companies.

- What is the post office PLI interest rate?

Answer-Following the conclusion of three policy years, loans may be taken from Endowment Assurance policies. After four policy years have passed, loans can be taken out under whole life assurance policies. For Postal Life Insurance policies, a half-yearly calculation determines the loan interest rate, which is 10% annually.