How To Surrender LIC Policy?

Let’s understand what is surrender of lic policy and how to surrender lic policy.

People can choose from a large selection of insurance offered by the Life Insurance Corporation of India. It is one among India’s oldest and most well-known insurance providers. Most people put some of their money into different sorts of securities. Saving money for the future is equally vital as investing for bigger profits.

LIC policies are typically long-term investments. However, they give you the choice to revoke your LIC coverage. Everything a person needs to know about surrendering a LIC policy is covered in this article. This article explains LIC surrender, the surrender value of a LIC policy, how to surrender LIC policy, and the paperwork required to withdraw from a LIC insurance.

What is surrender of lic policy?

The term “surrendering the policy” refers to ending a policy before it reaches maturity. The surrender value of a LIC insurance is the amount you would receive when cancelling a LIC policy online. If you made premium payments for three years in a row, your surrender value will be determined. If you decide to have your LIC policy closed before three years, there will be no surrender value. Additionally, you won’t receive a sufficient surrender value, so it is not at all advised to surrender the insurance. No financial advisor will ever advise you to discontinue your LIC coverage.

How to surrender lic policy?

The following actions must be taken by the policyholder in order to know ho to surrender LIC policy:

- The policyholder should go to the LIC branch that is closest to them and pick up a surrender discharge voucher. Form 5074 is the Surrender Discharge Voucher.

- The form must be completed and sent along with the necessary paperwork.

- The company would process the policy surrender after receiving the completed form and supporting documentation.

- When the surrender request is approved, the policyholder’s bank account will be credited with the surrender value.

- The policyholder may courier the surrender discharge voucher and the other paperwork to LIC’s headquarters in lieu of going to the branch office. Yogakshema Building, Jeevan Bima Marg, P.O. Box 19953, Mumbai 400 021 is the address.

Documents needed to surrender the lic policy

If the policyholder wants to know how to surrender lic policy, the following papers are necessary:

- Form 5074, Surrender Discharge Voucher

- Application for surrendering the policy NEFT Mandate form so that the policyholder’s bank account will receive the surrender value

- PAN Card Copies The first policy bond

- a returned check for the amount paid to the corporation in exchange for the policyholder’s bank account information

Things to Consider Before Surrendering Your LIC Policy

Look here for the things before you know how to surrender lic policy-

- Surrendering your policy means ending it before the policy’s maturity date.

- When you terminate your insurance, you will receive the surrender value.

- To calculate this sum, utilise a LIC surrender value calculator. If the premium is paid for three consecutive years, it will be calculated.

- If you cancel your insurance before the three-year mark, there will be no surrender value.

- No financial advisor will ever advise you to cancel the coverage because it won’t provide you with any benefits.

How to surrender lic policy online?

One of the most dependable investing options for Indian nationals is the LIC (Life Insurance Corporation of India). For its clients, the business offers a variety of insurance and investment programmes. Why do people then look up information on how to cancel or surrender a LIC policy?

- Sometimes, people rush through the process of choosing a policy or an investment and neglect to properly review all the details.

- Sometimes people choose insurance policies that are inappropriate for them, or they prefer to invest in a different policy that offers them more benefits.

How to surrender lic policy after 5 years?

Look here to know how to surrender lic policy –

You can withdraw from your LIC policy if five years have passed since you bought it. However, take in mind that the option to surrender a LIC policy is not yet offered online.

It would therefore be better if you cancelled the LIC policy through the LIC service branch.

This should ideally be the location where you purchased your LIC coverage.

Consider the situation when you have changed branches and are using the new branch. In that scenario, the service centre where you can use to cancel your policy will be that LIC branch. All of your policy documentation, including proposals forms, loan information, and other information, will only be available at the service branch, which is why you should go to there to surrender your insurance.

What is paid in case of surrender?

- Guaranteed Surrender Value (GSV)

The surrender value that is guaranteed by the plan is known as the Guaranteed Surrender Value (GSV). This value is calculated using one of the two formulas listed below:

GSV is equal to (total amount of premiums paid * GSV factor) plus (accrued bonus * GSV factor).

OR

GSV is calculated as [((((Number of premiums paid/Number of premiums payable)* Sum Assured) + Accrued Bonus]]. Note: GSV Factor

The LIC determines the GSV factor. The answer changes depending on the policy year in which the policy is given up. The GSV Factor would be higher the later the policyholder surrenders the coverage. For instance, in a 20-year policy, if the policy is surrendered in the 15th policy year rather than the 10th policy year, the GSV factor would be larger.

- Special Surrender Value (SSV)

The company determines the Special Surrender Value based on how well it is performing. The corporation may give a higher surrender value than the Guaranteed Surrender Value if it has been profitable in prior fiscal years. Based on the SSV variables provided by the corporation, the Special Surrender Value is calculated. The SSV factor, which is specified at the time the insurance is surrendered and is in turn dependent on the company’s performance. The SSV factor rises over time, much like the GSV factor does. The factor would be larger and vice versa if the policy were to be cancelled in a later policy year.

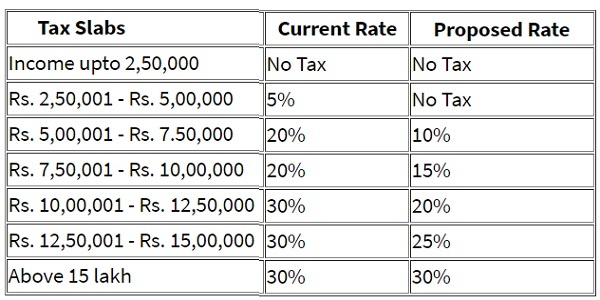

Read: Type of Pension Plan and Tax Benefits

How To Surrender LIC Policy?- FAQs

- Can I cancel my LIC before it matures?

Answer-The policyholder may only surrender their coverage within the guaranteed surrender value after three years have passed. This means that a minimum of three years must pass before the premium is paid. After three years, you can surrender for about 30% of the premiums you’ve already paid.

- When I resign my LIC coverage after five years, how much money would I receive?

Answer-If the policyholder has consistently paid premiums for five years, they will receive a 100% special surrender value.

- Is it possible to cancel my LIC policy online?

Answer-Yes, policyholders can cancel their LIC policies online before the policy term is out. This process is known as surrendering or closing a LIC insurance.

- Can I take money out of LIC?

Answer-Only after having paid the premium for roughly three years is a life assured eligible to surrender his or her LIC policy. While withdrawing the policy online, LIC gives the policyholder a specific sum of money.

- Can I cancel my Jeevan Anand insurance coverage before it matures?

Answer-As long as two complete years’ worth of payments have been paid, the policy may be relinquished at any time. After deducting the first year’s premium, the insurance company will pay a guaranteed surrender value of at least 30% of all premiums paid upon surrender after two policy years.