To know about Top 10 Loan Apps for Students in India. check this full article. Many students in India are unsure about how to obtain a student loan. They run into problems trying to locate urgent money to meet their necessities as a result.

Top 10 Loan Apps for Students

If you’re a student who needs money right away for school supplies, fees, or any other reason, download and use one of these Top 10 Loan Apps.

Now that our pocket money has run out for the month, it may often be very difficult for college students to keep up with our everyday costs. Instant Top 10 Loan Apps kicks into gear at that point.

You might not want to call your parents at that time to ask for money, so you can utilise these lending applications if you are going on a date and don’t have enough cash. The best thing is that you only need a simple college ID card to complete these Top 10 Loan Apps; you don’t need to have all of your paperwork verified via PAN Verification.

Read: How to get personal Loan with out Salary Slip.

Top 10 Loan Apps

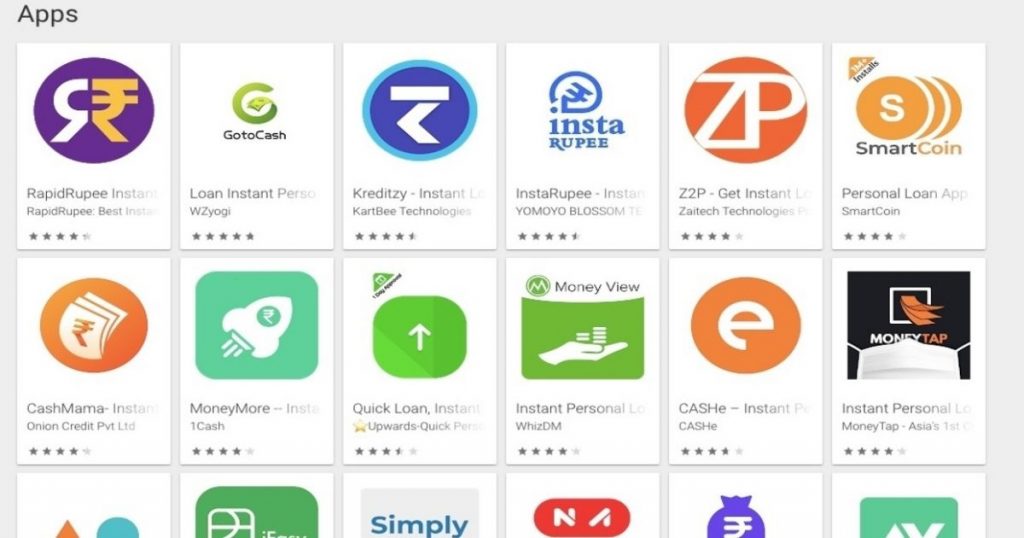

Take a look for a list of loan apps for students-

- Mpokket

- SlicePay

- Smartcoin

- KrazyBee

- Udhaar Card

- RedCarpet

- StuCred

- UGPG- Student Loans

- KreditBee

- ePayLater

- Bajaj Finserv

- BadaBro

- Cash Bean

- Sahukar

- mpokket

Read: Instant loan Apps in India

Top 10 Loan Apps For Students 2022

Here are the top10 loan apps for students-

1. StuCred

An app called StuCred was created specifically with college-bound students in mind. You can obtain a quick loan from StuCred at any moment, seven days a week. You can quickly apply for a loan after completing your ID verification by providing your address proof and student identification card.

As of right now, we can’t reveal all the names of the colleges where StuCred is no

in use, but you can give it a try. If your college is on the list, you can use the app without any problems.

2. Red Carpet

As the name suggests, this app gives students access to small loans.

Red Carpet exclusively offers loans between Rs. 1,000 and Rs. 6,000 because many students just need little sums of money and don’t want to be burdened with enormous debts.

You have three, six, or twelve months after the loan’s disbursement to decide whether to pay it back. The Paytm debit card will be charged from a bank account.

3. Sahukar

If you’re a student searching for small loans of up to Rs. 5,000, Sahukar is a good app. On the amount of your loan, they impose a monthly interest rate of 3%. You must be at least 18 years old and possess a legitimate student ID issued by a reputable college or university in order to be eligible.

Within 24 hours, your loan will be processed. The loan can be repaid in full within one to three months following the payout date.

4. BadaBro

A financing application created just for students is called BadaBro. For college students who are at least 18 years old, the BadaBro college loan programme provides fast loans up to Rs. 10,000. You will also want an Aadhar card and a PAN card to apply for BadaBro loans. Consider graduating at least three months after submitting your loan application.

You have 30 to 90 days to pay back the loan.

5. Pocketly

The third website on our list is named “Pocketly,” and it offers quick cash “anytime, anyplace!” The app is a leader in providing students in India with rapid loans, and they may rely on the platform for fundamental costs like tuition, extracurricular activities, and personal needs.

The Pocketly app, which is accessible on the Google Play store, allows you to quickly apply for loans between Rs. 500 and Rs. 6000 that can be paid back in manageable instalments with just one click. Nearly 1 to 3 months are allotted for credit repayment, and an interest rate of just 1 to 3% each month is being offered.

6. SlicePay

SlicePay provides EMI-free loans to students. They work with MasterCard to accomplish this.

You must download the app and enter information such as your name, the college you attend, the number on your ID card, and your Aadhar and PAN numbers. Students enrolled in undergraduate and graduate programmes can borrow up to Rs. 10,000 using SlicePay. Their 30- to 90-day lending terms are available. Additionally, SlicePay levies a monthly interest rate of 3%. The funds will be transferred to your bank account or, for quicker payout, through the Unified Payments Interface.

7. mPokket

If you’re seeking for a student loan to use for spending money in India, mPokket is the greatest option. Loans are available in sums between 500 and 20,000 rupees(A good student loan app) Students in college and recent graduates get the most from mPokket. This software is available to all students across the nation. To submit an application for a loan with mPokket, all that is required is a valid college ID and evidence of residence. A bank statement, a payment receipt, and documentation of identity and domicile are required from young professionals.

8. Krazybee

KrazyBee is an app that was created just for college students, so if you need some quick cash for textbooks, semester fees, or other e-commerce site purchases, KrazyBee will always be available for you. Applying for a loan is a straightforward process that only requires a few documents. Verify your address documentation and upload your college identification card with a short, crisp video of yourself. After two days of document verification by KrazyBee, you may quickly apply for the loan.

9. Bajaj Finserv

Bajaj Finserv’s card and app make it easy to purchase a range of products on loan, however it isn’t strictly a student loan app. One of the most popular goods that students buy is smartphones, which can be purchased using the Bajaj Finserv app. You can use free EMIs to pay for such purchases using the Bajaj Finserv app.

They also have a function that makes it possible to apply for bigger loans. However, students are not eligible for cash loans.

10. Cash Bean

One of the top student loan apps in India is Cash Bean. For smartphones running Android, it is accessible.

Up to Rs. 60,000 in fast loans are available at Cash Bean. They charge a processing and service fee equal to 18% of the loan amount sought.Additionally, the interest rate on your loan will be 33 percent annually. They use a paperless application method for loans. To be eligible for the loan, you must provide proof of your income. They complete the loan processing swiftly, usually in less than 48 hours. You must be between the ages of 21 and 56 to qualify.

Check: All Subject Syllabus for Students

Top 10 Loan Apps- FAQs

- Paysense security Is there or not?

Paysense uses SSL encryption to secure your private information and does not share it with outside marketers, so applying for rapid loans using this service is absolutely safe.

- Is Kreditbee legitimate or untrue?

The user of this platform categorically states and accepts that they are a natural or legal person who is at least 21 years old and has the legal capacity to create a contract in India.

- If an internet loan is not repaid, what happens?

The lender will notify you of the amount due to be paid if you don’t pay your EMI on the online loan. The loan can then be repaid with the lender’s specified penalty.

- Who is KreditBee’s owner?

The CEO and Co-Founder of KreditBee as well as a representative on the board of directors is Madhu (Madhusudan Ekambaram).

- What app offers loans without requiring documents?

Robocash provides you with a no-document cash loan. PAN card and address verification are all you require. You don’t need the original or scanned version of this document.