Difference between Trading Account and Demat Account in India

Difference Between a trading account and a demat account unclear? The crucial distinctions between Demat and Trading accounts are covered here. There are numerous opportunities to build riches on the stock market. No matter your job or social standing, investing should be a priority in every aspect of your life. You are shielded from a bad day. You must invest if you want to achieve your long-term financial objectives. You need a Demat and trading account to begin your stock market investing once you have determined an appropriate investment strategy. Although Demat and Trading accounts serve different purposes, you must have both of them in order to start making stock market investments.

Read: How to Become Smart investor?

Role of Demat and Trading account –

Here is the role of Demat and Trading account in the difference betweentrading and demat account-

- You cannot complete a trade without understanding demat and trading accounts, despite the fact that they appear to be very distinct from one another. You can purchase any company’s shares using trading accounts. Your bank accounts will be debited for the amount used to purchase these shares, and your demat account will display the credited shares.

- Additionally, when you sell shares through your trading account, your demat account is debited of the shares and your bank accounts are credited with the proceeds. It is safe to state that you need a demat account and trading account in order to initiate or complete a stock deal.

Read: Best Investment Blog in India

What Is A Trading Account For The Difference between Trading and Demat account?

Like A flow book is a trading account . That implies that the trading account is where your transactions are carried out. You must use the trading account you’ve set up with the broker whether you’re buying or selling shares. When you place a buy or sell order in the trading account, it first appears in the order book. Either a limit order or a market order may be put in. Market orders often execute right away, whereas limit orders are only carried out when the price condition is satisfied. As long as it’s still listed in the order book, an order placed in the trading account can be cancelled.

The trade book in your trading account is a log of all the trades you made that day. Equities, F&O, bonds, and ETFs can all be bought or sold using the trading account. If all of your trading will be in futures and options (F&O), you do not need a demat account and can get by with just a trading account.

What Is A Demat Account For The Difference between Trading and Demat account?

Dematerializing your shares, or converting them from a physical form to a digital one, is what a demat account does. Due to the fact that it maintains shares in digital form, it is sometimes referred to as a dematerialized account. You don’t need to own any shares in order to open a Demat account. Your account balance is permitted to be zero. A Demat account operates similarly to a bank account. While the Demat account keeps track of stock sales and purchases, the bank account keeps track of money transactions. Even other types of investments, like equity shares, bonds, government securities, and mutual funds, can be kept in a demat account.

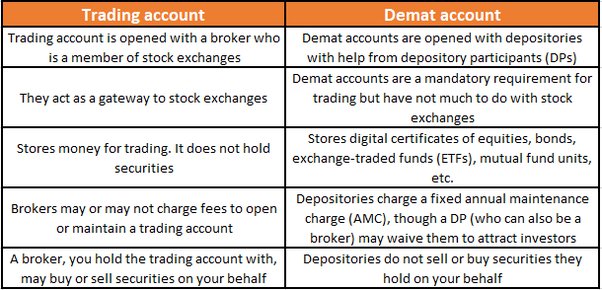

Here is the difference between Demat and Trading Account-

| S.no | DEMAT ACCOUNT | TRADING ACCOUNT |

| 1. | You store your financial instruments in a Demat account. | An account used for trading various financial instruments is a trading account. |

| 2. | You can maintain securities like stocks and equity derivatives in electronic format with the aid of a demat account. | You are able to trade stocks using a trading account. Equities can be bought and sold using trading accounts. |

| 3. | The Unique Demat Number assigned to your Demat account can be used to uniquely identify your account. | On the other side, a Unique Trading Number will be given to the trading account, which may then be used to transact in the stock market. |

| 4. | Due to its speedy completion, a Demat account lowers the danger of a delayed settlement. | Because it is done gradually over a while, settling a trading account takes time. |

| 5. | There is an annual maintenance fee for a Demat account that must be paid. | A trading account requires no expense to maintain. |

ZERODHA for understanding the difference between trading and demat account

An online bargain broker called Zerodha provides both trading and demat accounts. These accounts are used for trading in securities like bonds, stocks, and derivatives. Mutual Funds are also kept in the demat account. A 2-in-1 account from Zerodha combines trading and demat accounts and links them for simple online transactions.

Difference Between Demat And Trading Account In Hindi

Look for the difference between trading and demat account in hindi-

- पहचान नंबर- आपके डीमैट अकाउंट में एक यूनीक डीमैट नंबर होगा जिसका उपयोग आपके अकाउंट को अद्वितीय रूप से पहचानने के लिए किया जा सकता है. दूसरी ओर, ट्रेडिंग अकाउंट को एक यूनीक ट्रेडिंग नंबर सौंपा जाएगा जिसका उपयोग स्टॉक मार्केट में ट्रेड करने के लिए किया जा सकता है.

- IPO – इसके विपरीत, जो व्यक्ति शेयर बेचना नहीं चाहते हैं, वे ट्रेडिंग अकाउंट नहीं चुन सकते हैं. IPO के लिए अप्लाई करने के लिए ट्रेडिंग अकाउंट होना अनिवार्य नहीं है. इसके अलावा, अगर किसी के पास डीमैट अकाउंट नहीं है, लेकिन अभी भी ट्रेडिंग अकाउंट का मालिक होना चाहता है, तो वह भविष्य में व्यापार करने में सक्षम होगा और डेरिवेटिव मार्केट में विकल्प जिसके लिए शेयरों की आपूर्ति की आवश्यकता नहीं होती है.

- SEBI का अप्रूवल- यह प्रकट होता है कि डीमैट अकाउंट के लिए, SEBI और NSDL का अप्रूवल अनिवार्य है, जबकि ट्रेडिंग अकाउंट खोलने के लिए इसकी आवश्यकता नहीं है.

- वार्षिक मेंटेनेंस शुल्क (AMC)- ब्रोकरेज शुल्क के अलावा, डीमैट अकाउंट को सालाना बिल किए जाने वाले मेंटेनेंस शुल्क की आवश्यकता होती है. अकाउंट धारक को बिना किसी विफल के AMC के भुगतान करना होगा. दूसरी ओर, ट्रेडिंग अकाउंट के लिए, ऐसे शुल्क का भुगतान नहीं किया जाता है.

How To Open Demat Account ?

Here are the steps necessary to be taken for the difference between trading ad demat account:

- Contact your chosen Depository Participants to open a Demat account (DP). The list is accessible on the websites of National Securities Depository Ltd. and Central Depository Services Ltd.

- Fill out the account opening form and attach your identification and address proof documents.

- Sign the contract. Your rights and obligations as an investor/DP are outlined in this agreement.

- Congratulations! An account has been created for you. A Beneficial Owner Identification Number will now be given to you.

How To open a Trading Account?

The process of opening a trading account is easy and hassle-free. To ensure that the process goes smoothly, keep the necessary paperwork close at hand. To open a trading account to know the difference between trading and demat account and start your investment career, follow these steps:

- Compare the various service fees and features provided before choosing a broker.

- The account opening form should be completed. You must here supply your KYC information, address documentation, and ID documentation.

- Now, your application will be checked by the authorities.

- The information pertaining to your trading account will now be sent to you.

- Congratulations! You are prepared to start your stock market investing journey.

FAQs

- Do I require a trading and demat account?

Answer-Image for what separates a trading account from a depository account

To trade on the stock market, you must have both a Demat account and a trading account. A Demat account’s primary function is to provide the security required in a trading account for share purchases and sales.

- Who may submit a Demat and Trading Account application?

Answer-Any resident person, including minors, partnership businesses, and sole proprietorship businesses, is eligible to apply for both a Demat and a trading account.

- A trading and Demat account is what?

Answer-To place buy or sell orders on the stock market, you need a trading account. Shares purchased are deposited into the demat account, which serves as a bank, and shares sold are withdrawn from it.

- Can I have Possibly two trading accounts?

Answer-A trader is allowed to have numerous trading and demat accounts. There is only one restriction in this scenario: you are not permitted to open more than one demat and trading account with the same brokerage or depository participant.

- Which demat account is the top one in India?

AnswerThe most widely used, well-trusted, and dependable Demat accounts in India are Zerodha and Upstox.