Salary Slip Format: Every month, an employee receives a paper from their employer called a salary slip. From the gross wage to the net take-home pay and deductions, everything is shown. Every month, a wage slip is given out following the delivery of your pay by an employer. Knowing one’s pay stub is essential when changing jobs so that one can negotiate better pay at the new place of employment.

Salary Slip Format- How to make Salary Slip?

Here are all the specifics if you want to learn more about the salary slip format.

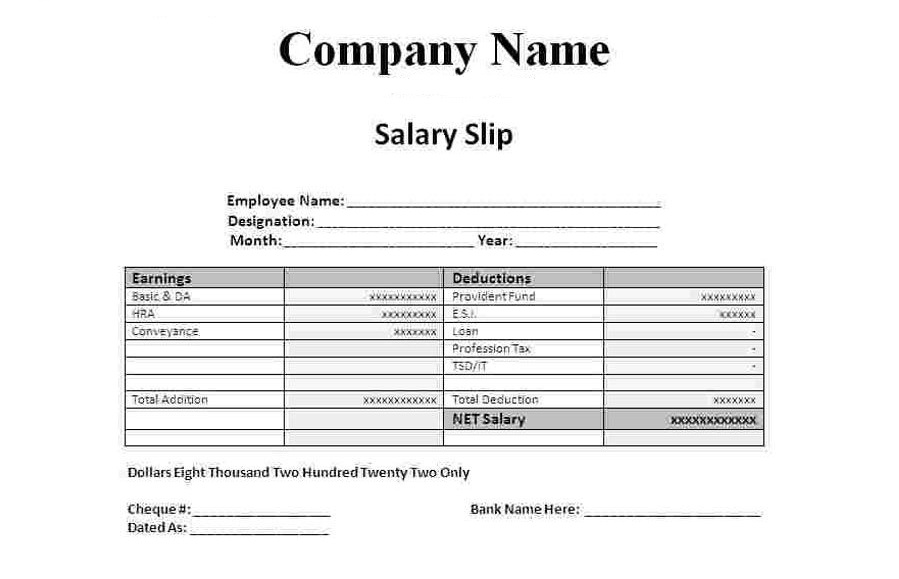

- The company name and company logo are required on the salary slip.

- Name of the employee to whom the pay stub is addressed. Along with the employee’s name, title, and department inside the business.

- Important information such as the employee’s name, address, and PAN or Aadhaar card number is needed on the salary slip

- Also necessary is the employee’s bank account number.

- Account information and the PF number for employees.

- the number of working days and leaves taken by employees per month.

- earnings and deductions for employees.

- UAN Number

- both the employee’s gross and net income.

Salary Slip Format in Excel, Word, PDF and Its Components

| COMPANY NAME | |||

| Address of the Company | |||

| Pay Slip for July 2022 | |||

| Name of the Employee | UAN | ||

| Employee ID | PF No | ||

| Designation | ESI No | ||

| Department | Bank Name | ||

| DOJ | Bank A/C No | ||

| Total Working Days | Paid Days | ||

| LOP days | Leaves Taken | ||

| Earnings | Deductions | ||

| Basic Wage | ₹0.00 | EPF | ₹0.00 |

| HRA | ₹0.00 | Professional Tax | ₹0.00 |

| Conveyance Allowances | ₹0.00 | TDS | ₹0.00 |

| Medical Allowances | ₹0.00 | ESI/Health Insurance | ₹0.00 |

| Other Allowances | ₹0.00 | ||

| Total Earnings | ₹0.00 | Total Deductions | ₹0.00 |

| Net Salary | ₹0.00 | ||

Importance of Salary Slip

Salary slips are a crucial piece of work documentation. You can use it to aid you in the following significant life pursuits:

- Acts as a means of proving employment

An easily accessible document to demonstrate your continuous work is a wage slip.

- Becomes the foundation for paying income taxes

A varied amount of tax will apply to various parts of your salary. Your wage structure, which is presented in your salary slips, serves as the basis for your tax estimate for the fiscal year.

- Useful when looking for a job in the future

Typically, your previous drawing salary determines your pay at the new job. Salary slips aid in salary negotiations with the following employer.

- Aids in Loan Access

The salary stubs you submit with your loan application is crucial. Your salary structure and the amount of money you receive each month will determine whether you qualify for the loan.

- Income Verification for Credit Cards and Insurance

Since your income determines your maximum eligibility for life insurance, you must provide proof of income when buying life insurance. The same goes for your credit card limit, which is determined by your income. So, for both parties, a salary slip is a crucial confirmation of income and employment.

Components of Salary Slip

- Incomes

- Deductions

-

Incomes

Dearness Compensation

Employees receive DA as compensation to help offset the effects of inflation on their pay. Typically, it represents 12% of the base income. Employers in Bangladesh, Pakistan, and India provide Dearness Allowance compensation as a way to offset the effects of inflation on living expenses. Government workers, those working in the public sector, and pensioners all have access to DA, which is calculated automatically. Both basic pay and DA are entirely taxed. On the income side of the employee wage slip or salary statement, it appears after the basic pay. You receive DA as part of your salary.

Basic Salary

This accounts for between 35% and 40% of your pay, making it arguably the most significant. It also acts as a foundation for figuring out the other salary-related factors.

HRA (House Rent Allowance):

It is a stipend to assist people in covering their housing rent. The HRA ranges from 40% to 50% of base pay, depending on the locality. According to Section 10 of the Income Tax Act of 1961, you may deduct a portion of the HRA from your taxes if you rent your home.

Travel Expenses

While you are alone, the allowance pays for your travel as well as the costs of your immediate family. On the travel expenses paid by your company when they depart, income tax exemption is attainable. You must provide documentation of your trip in order to receive the discount. However, the exemption for outbound travel is only valid for two trips.

Medical Reimbursement

An employer permanently pays its employees the medical allowance that appears on their pay stubs. When it is in the employee’s possession, this sum is wholly taxable.

Special Compensation

The remainder of the total compensation is shown by the special allowance component of a salary pay slip, which is wholly taxable. It is recommended that you select any tax-saving options that your employer may provide, such as a free lunch pass, under this section of the salary slip. The remaining balance of the payment, if any, is added to the total take-home pay.

Other Allowances

This category includes all of the extra allowances that an employer may pay for whatever purpose. Such allowances may be categorised by an employer under a particular heading or with “Other Allowances.”

-

Deductions

Parts of CTC are subtracted from employees’ take-home pay as a result of deductions in the wage structure. On the right side of the payslip, we list all forms of deductions. Let’s look at the potential deductions included on an employee’s salary slip format

1. Provident Fund

The formula for the provident fund (PF), which is 12% of basic pay plus dearness and special allowances, is shown below. Both the company and the employee are required to contribute 6% apiece. This is applicable to businesses with 20 or more full-time employees. Provident Fund must be withheld if an employee’s Basic + DA + Special Allowance totals less than Rs. 15,000. When starting a new job and without a UAN, other employees earning more than Rs. 15,000 have the option to opt out by completing Form 11 or to have PF deductions made with n Rs.15,000 cutoffs. The minimal monthly contribution for employees who have UAN is Rs. 1800.

2. Professional Tax

Governments impose a tax known as the professional tax on salaried workers. Karnataka, Bihar, West Bengal, Andhra Pradesh, Telangana, Maharashtra, Tamil Nadu, Gujarat, Assam, Chhattisgarh, Kerala, Meghalaya, Odisha, Tripura, Madhya Pradesh, and Sikkim are the states that charge a professional tax. Where appropriate, the amount of professional tax that is deductible varies from state to state.

3. Employee State Insurance

Employees whose gross salaries do not exceed Rs. 21,000 must make Employees State Insurance Deductions toward ESI. It is only applicable to businesses with at least 20 employees earning up to Rs. 21,000 in gross wages. Employers must contribute 4.75% of the gross pay, and employees must contribute 1.75 percent of the gross wage.

Salary Slip Format- FAQs

- What does a salary slip mean?

Answer- A monthly document that is given to employees by their employers is known as a salary slip or payslip. A pay stub includes a thorough analysis of the employee’s earnings and deductions for a specific time period.

- Why is it crucial to comprehend a salary slip?

Answer-Understanding the pay stub is crucial since it clarifies the components of one’s compensation. The pay stub also serves as employment documentation. Additionally, it aids in the preparation of income tax returns, the application process for loans and mortgages, and salary negotiation while looking for a new position.

- How do I access my pay stub?

Answer-Every month, the employer gives you a pay stub. The company will either print or email you a pay stub. On the internal site for your employees, you may also view the pay stub.

- What does a simple pay slip mean?

Answer-The entire monthly take-home pay is the fundamental component of any salary pay slip. The typical range is between 30 and 50 percent of the entire compensation on offer.